Jump to:

- What Is Labor Cost?

- How Can I Calculate My Restaurant Labor Cost Percentage?

- How Can I Control My Labor Costs?

- Keep Your Restaurant Profitable

Most people get into the restaurant industry because they love to cook or because they have a flair for providing a unique dining experience. It is rare for a restaurateur to get into the business because they love doing math. And yet so much of your restaurant’s success is dependent on math.

There are a number of critical metrics that a restaurant owner must calculate in order to ensure that their business is profitable. Before even starting your restaurant, you will need to run numbers on everything from price per square foot of your space to food cost percentage. After you open, you will need to constantly reassess these and other numbers to make sure that you are maintaining your profit margin.

A key number that must be included in these calculations is your labor cost percentage. Setting a target for the percentage of your budget that goes to labor can help you stay on track financially. Below, we outline what labor cost percentage is – and how you can calculate it for your own restaurant.

What Is Labor Cost?

As a restaurant owner, you will need to figure out your precise labor cost. A common mistake that many restaurateurs make is to only include the wages of their employees (salaried and payroll). While wages make up the bulk of your labor costs, it typically does not represent the full picture.

Instead, you will need to take all costs associated with having employees. This includes direct wages for hourly employees, wages for salaried employees, and additional expenses such as healthcare, payroll taxes, workers’ compensation insurance, and Social Security taxes. To determine your restaurant labor cost, you simply add up all of these expenses.

Keep in mind that your restaurant labor costs may vary month to month, particularly if you operate a seasonal business. For example, if you run a barbeque restaurant that is busy in warmer weather months due to outdoor seating but less busy in the winter months, you may find that your labor costs shoot up significantly during the summer.

On its own, restaurant labor cost doesn’t mean much. It tells you how much you are spending to have employees, but you won’t know if this expense is appropriate until you take the next step: calculating restaurant labor cost percentage for your business.

How Can I Calculate My Restaurant Labor Cost Percentage?

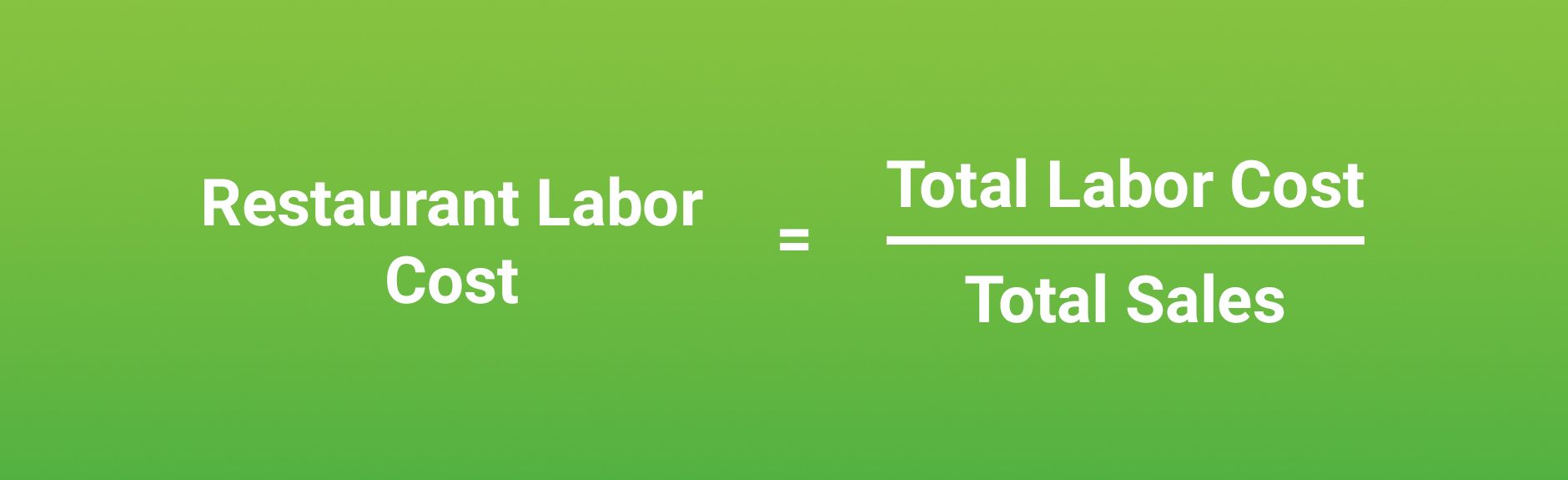

Restaurant labor cost percentage tells you how much of your profits over a period of time are going to pay your employees. It is determined by calculating your labor cost for a set period of time (such as one month), and then dividing that number by your total sales for the same period of time. This gives you your labor cost percentage, which is an important metric to see how your labor costs affect your profitability.

For example, you run a small family restaurant, with three cooks and four servers on staff while you are open. Each of your employees works 8 hours each day, and is paid $12 per hour. Your restaurant is open 6 days a week, and averages $15,000 in sales each week. The FICA tax rate for employers is 7.65% of each employee’s gross pay, your workers’ compensation insurance rate is $0.35 for every $100 in payroll, and you pay $240 per month per employee for health insurance.

Each day, your wage cost is $672 (7 employees x $12 per hour x 8 hours + ). The daily cost in FICA tax is $51.41 ($672 x 7.65%). Your daily cost in workers’ compensation insurance is $2.35 ($672 x .0035) and your daily health insurance cost is $56 ($240 x 7 employees / 30 days in the month). This makes your total labor cost each day $781.76 ($672 in employee wages + $51.41 in FICA tax + $56 in health insurance expenses + $2.35 in workers’ compensation insurance). That makes your total labor cost for the week $4,690.56 ($781.76 x 6 days a week). When you divide $4,690.56 by $15,000, you arrive at 0.3127, or 31.27%.

Many experts recommend that your labor cost percentage be 30% or less. However, this number may vary significantly depending on the type of restaurant that you operate and other factors. If you are running a fast casual dining establishment without servers, for example, your labor cost percentage may be significantly lower than a fine dining restaurant.

Labor cost percentage may also vary from month to month. As described above, some restaurants have busier times of year, where their labor costs and revenues both increase. In slower months, you may cut your staffing to minimal levels, but you still have to pay your salaried employees. This can cause your labor cost percentage to rise during slower times, and drop during busier times.

Because labor cost percentage can rise and fall significantly, it is important to not only calculate this number, but to keep an eye on overall budget and sales targets. In this way, you’ll be able to make sure that you are appropriately staffed and hitting the right labor cost percentage based on your sales – which can increase your profitability.

Using labor cost percentage to determine if you need to bring on another employee – or reduce staffing levels – is a smart move. For example, if your popularity explodes and you have a line out the door, waiting for tables, adding another cook may actually decrease your labor cost percentage because it allows you to serve more people.

Similarly, if your sales drop, it is a good indication that you may need to trim your labor costs. While the 30% labor cost percentage is just a target, if you find yourself going significantly above 30%, it may be a signal that you should reduce staffing in order to increase profitability.

How Can I Control My Labor Costs?

Keeping your labor costs low can seem like an impossible task. After all, you need a certain number of employees in order to run your restaurant, and some expenses – like hourly wages – are fairly fixed. However, there are ways that you can keep your labor costs (and therefore your labor cost percentage) relatively low.

First, take a look at your operations. Is there any way to increase efficiency? For example, if you reconfigure your kitchen, you may be able to increase the amount of food that your cooks can put out, which will increase your sales.

Second, watch your payroll for overtime hours. Sometimes, overtime is unavoidable, but if you are consistently paying out overtime, it can significantly increase your labor costs. You may institute a policy of overtime only allowed when approved by management, or even bring on an additional employee to avoid paying out overtime.

Third, consider cross-training your staff. This way, if you’re short-staffed, you won’t need an employee to work a double shift (which means overtime pay). Instead, another employee can fill in for them.

Fourth, invest in efficient equipment and technology. While you may pay more up front to purchase a commercial grade mixer, for example, if it cuts food prep time by half, it will allow you to reduce your labor costs.

Keep Your Restaurant Profitable with Afforded Branded Items

There are so many factors that go into your restaurant’s profitability, from labor cost to equipment expenses to the cost of ingredients to make your food. While many things about your restaurant’s profitability are outside of your control (such as shut-down orders during the COVID-19 pandemic), there are a number of steps that you can take to control your costs and increase the likelihood of success.

Now more than ever before, restaurants rely on take-out business to sustain them. At Budget Branders, we understand that small and medium sized businesses are in a financial crunch during these times. That is why we offer custom branded cups, bowls, bags, coffee sleeves and more at affordable prices and in quantities that make sense for your restaurant.

Whether you’re just getting started or are an established business, we are here to help. Contact us today by pressing the live chat button, calling 888-373-4880 to talk to a sales representative, or filling out our online contact form for assistance with your restaurant’s specific needs.